Sky High Lumber Prices are About Supply (and Demand)

By Phil Crone, Executive Officer, Dallas Builders Association

Make no mistake, residential construction has largely thrived despite the COVID-induced disruptions and despair that have crippled so many other industries. Fueled by record low mortgage rates and demand induced by the newfound importance of home, all of the ingredients are there for 2021 to set an all time regional record for housing starts.

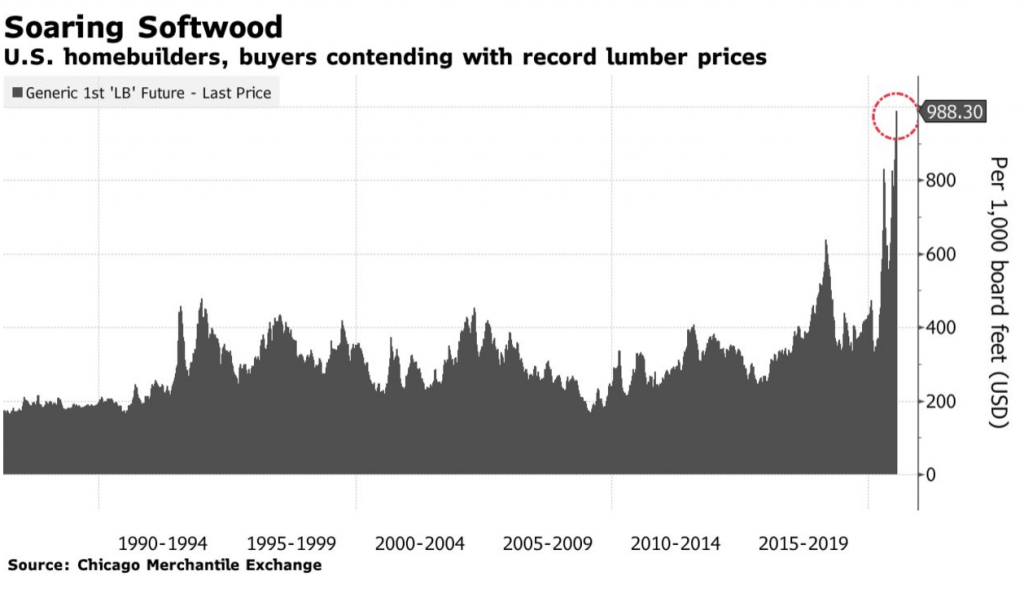

Significant headwinds facing the market now may imperil attainment of the 52,000 housing starts we would otherwise be destined for. More importantly though, skyrocketing lumber prices are quickly taking many of those homes out of reach for thousands of families.

Since last spring, lumber prices have increased by more than 180 percent, increasing the price of an average new single-family home by more than $24,000, according to the National Association of Home Builders (NAHB). To put that into perspective, just a $1,000 cost increase prevents 20,000 Texas families from affording a new single-family home according to the Real Estate Center at Texas A&M.

Much has been made about how demand is driving these increases; and it certainly has. However, it is just as much about supply or a lack thereof.

A year ago, mill operators and lumber dealers completely misread the market. Frankly, we all did. Just before the pandemic, housing starts and remodeling were trending slightly weaker nationwide. At that time, the industry was contending with stiff tariffs on Canadian lumber imposed in the early days of the Trump administration that have since been cut in half and deemed to lack factual justification by the World Trade Organization.

Per the graph below, this constituted the largest pre-COVID spike. At the time, domestic lumber producers, who lobbied heavily for the tariffs, were able to lower production and raise prices with impunity by competition stifling from our northern neighbor, who supplied the overwhelming majority of our foreign lumber supply. Once the housing industry raised concerns of nefarious behavior to the Commerce Department, prices almost immediately normalized.

By May and June of last year, it was obvious to everyone that the housing boom was here to stay. Home was more important than ever and it was clear it would remain that way for many months as the pandemic dragged on. Even then, lumber producers refused to answer the bell on demand and inexplicably let inventory drop to record levels in the fall of 2020.

Here in DFW, the Q4 2020 was the best final quarter on record, providing more than 13,000 housing starts according to Zonda. In fact, it was the fourth highest quarter ever for our region with an increase of nearly 40% year over year.

Month after month, quarter after quarter, the signs were crystal clear, the trends were glaringly obvious, yet most lumber mills blundered along producing way short of capacity. Many were only running two of three possible shifts in a time of rampant unemployment. Something stinks here.

It is easy to excuse the “sky is falling” reaction we all had last March and April for lumber mills getting behind the 8-ball during the demand surge that followed in the summer. It is not so easy to explain or excuse why this continues to be the case.

It is Econ 101. If you have a product that is in high demand, you sell more of it, and if you don’t, someone else will. Unfortunately, “someone else” in this case is either 1) foreign competition, which is still curtailed by tariffs in the case of Canada or by high transportation costs in the case of other countries; or 2) domestic competition. In the second case, despite fervent promises, there was a stunning lack of it demonstrated in the wake of the Trump tariffs and, to me, that’s part of what stinks right now.

On March 4, Reps. Jim Costa (D-Calif.) and Jodey Arrington (R-Texas) sent a letter to President Biden and the Department of Justice on March 4 urging the administration to respond to rising building materials prices and supply shortages, particularly, lumber, that are harming the housing market and threaten the economic recovery.

Reps. Costa and Arrington mirrored my concerns and stressed the need to boost sawmill activity in their letter to Biden and the Department of Justice. “Unfortunately, this unprecedented price increase on new homeowners, as well as home builders, will persist until new sawmills come online and current mills re-open and operate at full capacity,” the letter stated. “To address this issue, we ask your Administration to facilitate a discussion with all stakeholders, including sawmills, home builders, loggers, and distributors, to ensure all needs are met in a timely manner.”

Builders anticipate that supply side challenges will provide massive limitations in 2021. Every Dallas BA member I speak to has this on the top of their mind. Which is why it will be a focus of our State of the Industry Summit on March 25, which you can register for at DallasBuilders.org.

According to a recent NAHB study, builders across the nation feel the same way, with materials pricing and availability and delivery times of materials cited as the two most significant issues in the market right now. With safe and effective vaccines providing more optimism on the employment and economic front, the demand for lumber will continue to be high. So will prices unless producers supply what the market needs.